Özkan, İbrahim

Loading...

Profile URL

Name Variants

Ozkan, Brahim

Ozkan, Ibrahim

Özkan, İ.

Ozkan, Ibrahim

Özkan, İ.

Job Title

Prof. Dr.

Email Address

iozkan@cankaya.edu.tr

Main Affiliation

03.07. Yönetim Bilişim Sistemleri

Yönetim Bilişim Sistemleri

03. İktisadi ve İdari Birimler Fakültesi

01. Çankaya Üniversitesi

Yönetim Bilişim Sistemleri

03. İktisadi ve İdari Birimler Fakültesi

01. Çankaya Üniversitesi

Status

Current Staff

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Files

Sustainable Development Goals

4

QUALITY EDUCATION

1

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

1

Research Products

10

REDUCED INEQUALITIES

3

Research Products

14

LIFE BELOW WATER

1

Research Products

17

PARTNERSHIPS FOR THE GOALS

1

Research Products

Documents

31

Citations

320

h-index

9

Documents

25

Citations

271

Google Analytics Visitor Traffic

| Journal | Count |

|---|

Current Page: 1 / NaN

Scopus Quartile Distribution

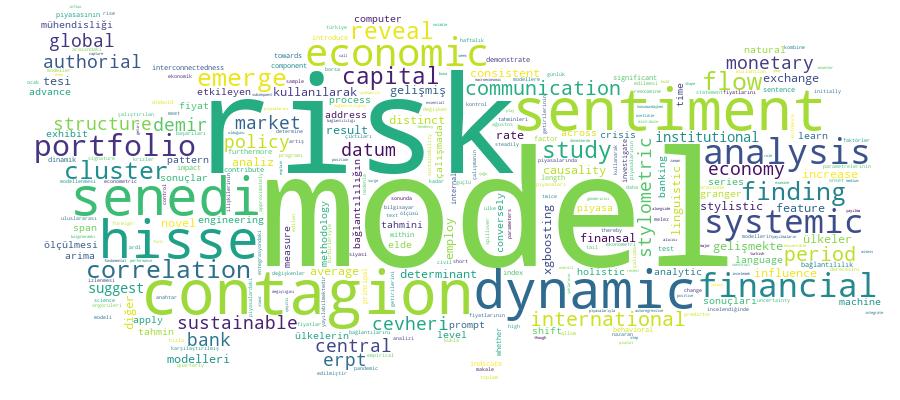

Competency Cloud

7 results

Scholarly Output Search Results

Now showing 1 - 7 of 7

Article Stylometric Analysis of Sustainable Central Bank Communications: Revealing Authorial Signatures in Monetary Policy Statements(MDPI, 2025) Emekci, Hakan; Ozkan, IbrahimSustainable economic development requires transparent and consistent institutional communication from monetary authorities to maintain long-term financial stability and public trust. This study investigates the latent authorial structure and stylistic heterogeneity of central bank communications by applying stylometric analysis and unsupervised machine learning to official announcements of the Central Bank of the Republic of Turkey (CBRT). Using a dataset of 557 press releases from 2006 to 2017, we extract a range of linguistic features at both sentence and document levels-including sentence length, punctuation density, word length, and type-token ratios. These features are reduced using Principal Component Analysis (PCA) and clustered via Hierarchical Clustering on Principal Components (HCPC), revealing three distinct authorial groups within the CBRT's communications. The robustness of these clusters is validated using multidimensional scaling (MDS) on character-level and word-level n-gram distances. The analysis finds consistent stylistic differences between clusters, with implications for authorship attribution, tone variation, and communication strategy. Notably, sentiment analysis indicates that one authorial cluster tends to exhibit more negative tonal features, suggesting potential bias or divergence in internal communication style. These findings challenge the conventional assumption of institutional homogeneity and highlight the presence of distinct communicative voices within the central bank. Furthermore, the results suggest that stylistic variation-though often subtle-may convey unintended policy signals to markets, especially in contexts where linguistic shifts are closely scrutinized. This research contributes to the emerging intersection of natural language processing, monetary economics, and institutional transparency. It demonstrates the efficacy of stylometric techniques in revealing the hidden structure of policy discourse and suggests that linguistic analytics can offer valuable insights into the internal dynamics, credibility, and effectiveness of monetary authorities. These findings contribute to sustainable financial governance by demonstrating how AI-driven analysis can enhance institutional transparency, promote consistent policy communication, and support long-term economic stability-key pillars of sustainable development.Article Gelişmiş ve Gelişmekte Olan Ülkelerin Hisse Senedi Piyasalarında Bağlantılılığın Ölçülmesi ve Ağ Analizi(2024) Oral, Fatmanur; Ozkan, IbrahimÜlkeler arasındaki siyasi, ekonomik ve finansal entegrasyondaki artış uluslararası piyasa bağlantılarını etkilemektedir. Finansal krizler ülkeler arasında hızla yayılabilmektedir, bu nedenle hisse senedi piyasalarının birbirleriyle olan ilişkilerinin izlenmesi ve ölçülmesi önemlidir. Bu makale gelişmiş ve gelişmekte olan toplam 13 ülke için Ocak 1997'den Ağustos 2017'ye kadar günlük hisse senedi getirilerini kullanarak finansal piyasalardaki bağlantılılık derecesini araştırmaktadır. Diebold ve Yilmaz'ın (2009-2012) bağlantılılık ölçüsü, tüm hisse senedi piyasaları için borsa getirilerinin bağlantılılığını ve yayılmaların yönünü incelemek için uygulanmıştır. Buna ek olarak, çalışmada ABD hisse senedi piyasasının diğer tüm hisse senedi piyasalarıyla dinamik bağlantılılığı analiz edilmektedir. Sonuçlar, ABD hisse senedi piyasasının çeşitli bölgelerdeki diğer hisse senedi piyasalarını en çok etkileyen piyasa olduğunu göstermektedir. Dinamik analiz sonuçları, bağlantılılığın zaman içinde, özellikle de çalkantılı dönemlerde değiştiğini ortaya koymaktadır. Gelişmiş ülkelerin çoğu getiri yayılma şoklarının göndericisi konumundayken, gelişmekte olan ülkeler alıcısı konumundadır.Article Citation - WoS: 9Citation - Scopus: 13The Determinants of Systemic Risk Contagion(Elsevier, 2024) Atasoy, Burak Sencer; Ozkan, Ibrahim; Erden, LutfiThe elevated interconnectedness of the global financial system has resulted in an increased frequency of financial crises, characterized by the swift transmission of turmoil between countries. This study introduces a novel quantile-connectedness-based contagion metric and investigates the drivers of systemic risk contagion, employing methodologies that address endogeneity and time-variation. We analyze data spanning two decades from 27 international banks and encompassing balance sheet-derived variables. Our findings indicate that contagion during the 2004-2021 period is largely driven by credit risk and leverage, while the impact of size and capital adequacy weakens after 2012. Furthermore, funding structure and profitability only display a significant effect during the 2014-2017 and Covid-19 periods, respectively. We also observe distinct peaks and troughs in each bank's systemic risk propagation, although they share commonalities with their counterparts. Given our findings, we suggest a holistic systemic risk surveillance model that employs high-frequency data and simultaneously incorporates multiple risk factors.Article Citation - WoS: 2Citation - Scopus: 3Economic Sentiment and Foreign Portfolio Flows: Evidence From Türkiye(Central Bank Republic Turkey, 2024) Ozkan, Ibrahim; Erden, Lutfi; Gunes, DidemThe notable surge in capital flows in recent years has emerged as a key factor shaping the dynamics of international financial markets and influencing economic performance of emerging economies. Even though macroeconomic fundamentals of an economy can explain some of the patterns in international capital flows, behavioral factors also seem to be essential for positioning capital flows across countries. In this study, we aim to examine whether overall economic sentiment towards Turkish economy plays a significant role on net portfolio flows to Turkiye. To this end, we first construct a novel text-based sentiment index called "Turkish Economic Sentiment Index (TESI)", to capture the behavioral tendencies of international investors and media towards Turkiye. Our subsequent step integrates TESI into autoregressive distributed lag models (ARDL) alongside major pull-push determinants to assess whether market sentiment holds discernible influence on capital influx into Turkey. The results reveal that the TESI and VIX stand out as pivotal determinants influencing international portfolio flows. The TESI has a positive impact on portfolio flow dynamics, whereas the degree of global risk aversion inversely affects these flows. These findings align with the contention that a favorable sentiment can boost portfolio inflows to emerging markets. Conversely, heightened volatility expectations in global markets can prompt outflows from these economies.Article Citation - WoS: 1Citation - Scopus: 1Time-Varying Exchange Rate Pass-Through Over 2005-2021 Using Dynamic Model Averaging(Elsevier, 2024) Colak, Yasemin; Erden, Lutfi; Ozkan, IbrahimThis study reexamines the time-varying structure of exchange rate pass-through (ERPT) by employing the dynamic model averaging (DMA) method. DMA is a novel empirical methodology that allows both parameters and predictors of the model to change over time, thereby addressing model uncertainty in determining time-varying ERPT degrees. We apply DMA to quarterly time series data spanning from 1996:1-2021:3 for each of the 39 advanced and emerging economies in the sample. The findings reveal a shift in short run ERPT dynamics prompted by the global crisis in 2008-09. While ERPT levels are initially low, they have been rising steadily since the onset of the pandemic across all advanced countries. Conversely, the ERPT levels are approximately twice as high in emerging economies, exhibiting a U-shaped pattern over the sample period.Article Citation - WoS: 3Citation - Scopus: 3Correlation Meets Causality: a Holistic Measure of Financial Contagion(Academic Press inc Elsevier Science, 2024) Atasoy, Burak Sencer; Ozkan, BrahimThis study introduces a new measure of financial contagion. We argue that a rapid increase in correlations between two series is necessary but not sufficient for contagion to occur, and develop a contagion test that combines dynamic conditional correlations with time-varying Granger causality. We empirically illustrate our new approach using systemic risk data covering the period 1996 - 2023. We show that there are periods when correlations increase rapidly without causality, as well as periods when causality is present but correlations do not increase. The proposed test enables data-driven detection of contagion episodes and provides a clear distinction between interconnectedness and contagion.Master Thesis Demir Cevheri Fiyatlarının Modellenmesi ve Tahmini(2024) Yalçın, Umutcan; Özkan, İbrahimÇalışmada demir cevheri fiyatlarını etkileyen faktörler analiz edilmiştir ve demir cevheri tek değişken olarak kullanılarak haftalık fiyat tahmin modelleri oluşturulmuştur. Fiyatlar, ETS, ARIMA, XGBoosting modelleri ve bu modellerin kombine edilmesi ile elde edilen melez bir model (forecast combination) kullanılmıştır. Model parametrelerinin tahminleri, model çıktıları ve öngörüleri R programı kullanılarak elde edilmiştir. Çalışma sonunda kullanılan modeller karşılaştırılmış ve model başarıları tartışılmıştır. Çalışmanın sonuçları incelendiğinde kukla değişkenler kullanılarak çalıştırılan XGBoosting modeli diğer modellere nazaran daha güçlü sonuçlar sunmuştur. Anahtar Kelimeler: Demir cevheri, Fiyat tahmini, Tahmin modelleri, ETS, ARIMA, XGBoosting