Temiz, Dilek

Loading...

Profile URL

Name Variants

Temiz Dinç, Dilek

Temiz, Dilek

Temiz, D.

Dinç, Dilek Temiz

Dinc, Dilek Temiz

Temiz, Dilek

Temiz, D.

Dinç, Dilek Temiz

Dinc, Dilek Temiz

Job Title

Prof. Dr.

Email Address

dilektemiz@cankaya.edu.tr

Main Affiliation

Uluslararası Ticaret ve Finansman

Status

Current Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Files

Sustainable Development Goals

1

NO POVERTY

2

Research Products

4

QUALITY EDUCATION

1

Research Products

7

AFFORDABLE AND CLEAN ENERGY

6

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

22

Research Products

9

INDUSTRY, INNOVATION AND INFRASTRUCTURE

4

Research Products

10

REDUCED INEQUALITIES

10

Research Products

11

SUSTAINABLE CITIES AND COMMUNITIES

1

Research Products

13

CLIMATE ACTION

2

Research Products

14

LIFE BELOW WATER

2

Research Products

15

LIFE ON LAND

1

Research Products

17

PARTNERSHIPS FOR THE GOALS

17

Research Products

Documents

20

Citations

223

h-index

6

Documents

6

Citations

75

Scholarly Output

47

Articles

38

Views / Downloads

4225/2105

Supervised MSc Theses

2

Supervised PhD Theses

0

WoS Citation Count

127

Scopus Citation Count

166

WoS h-index

4

Scopus h-index

5

Patents

0

Projects

0

WoS Citations per Publication

2.70

Scopus Citations per Publication

3.53

Open Access Source

21

Supervised Theses

2

Google Analytics Visitor Traffic

| Journal | Count |

|---|

Current Page: 1 / NaN

Scopus Quartile Distribution

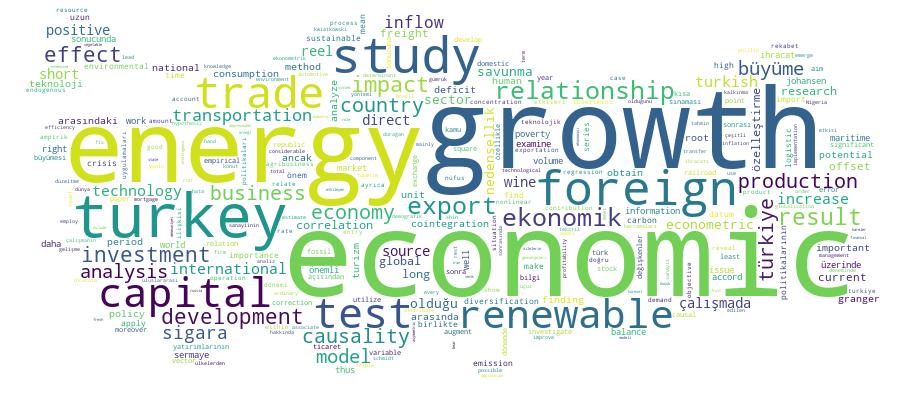

Competency Cloud

Scholarly Output Search Results

Now showing 1 - 10 of 47

Article Citation - WoS: 2The Relationship Between Triple Deficit and Growth: The Case of Turkey(Eskisehir Osmangazi Univ, Fac Education, 2015) Berke, Burcu; Temiz, Dilek; Temiz, Dilek; Karakurt, Eda; Uluslararası Ticaret ve FinansmanMacroeconomic equilibrium in an economy is provided by equalizing of internal and external economic balances. While internal economic balance consists of saving-investment balance of the private sector and the income-expenditure balance of the public sector (budget balance), the external economic balance is comprised of the current account balance. According to this equation, when both internal economic balances gave deficits, it is required that the current account balance is expected to give a deficit up to them. This situation is defined as "triple deficit". Triple deficits are generally a problem occurring in the economies trying to grow over the potential, in which there is an insufficient domestic savings. Therefore, it must have been examined the relationship between triple deficit and growth in Turkey. In this study, the effect of each component (balances) of the "triple deficit" hypothesis on growth are studied by VAR model during period of 2003Q2-2012Q4 in Turkey and it is found that these balances are the most explaining variables the growth.Article The Impact of Technology on Economic Growth in Turkey(Inderscience Publishers, 2025) Ercan, M.; Temiz, D.; Gökmen, A.The Turkish economy has been suffering from trade imbalance for a long time. Exporting high value-added products will diminish Turkey’s dependence on foreign resources for capital and imported products. At the same time, it may be possible to divert more resources from gross domestic product (GDP) to R&D funds. Appropriate and efficient usage of technology will help companies innovate and find new areas of employment. As a result, the Turkish economy may have a better chance of obtaining a sustainable economic growth for the longer term. This study concludes that increased R&D expenditures leads to a rise in technology and this in turn contributes positively to economic growth. The results obtained from the study show that technology affects Turkey’s economic growth. Therefore, Turkey needs to work harder in the field of technology in order to achieve sustainable growth. Improving the situation and quality of research and development activities in Turkey, encouraging research and development investments by both the government and the business sector should be priority reform movements for Turkey. Policy makers should support science and technology, make institutional arrangements for intellectual property rights and raise the level of education, and make arrangements to increase R&D spending. © 2025 Elsevier B.V., All rights reserved.Article Analysis of Maritime Transportation Sector Through Econometric Modelling Concerning Relationship Between Foreign Trade and Freight Transportation in Türkiye(Univ Rijeka, Fac Maritime Studies, 2024) Gurses, Cemre; Temiz, Dilek; Yurtseven, Omer; Kanik, Zehra B.; Gokmen, AytacThe main objective of this study is to investigate the effect of freight transportation on foreign trade in the Turkish maritime transportation sector. Data gathered from the Turkish Statistical Institute and the Ministry of Transport and Infrastructure's official websites, between the years 2013 and 2023, were utilized and time series analysis was conducted. The Industrial Production Index was used as a proxy for economic expansion. This research used five variables, all shown in logarithmic form (Export, Import, Volume, Handling, and Index). Unit root tests were done to examine the stationarity of the series. Regression analysis was conducted utilizing the Ordinary Least Squares (OLS) method to ascertain the short-term direction of the relationship between the variables. The findings from the Toda-Yamamoto causality test align with those derived from OLS and affirm that within the maritime sector, sea freight transportation exerts a positive impact on foreign trade, particularly in the short term.Article Sigara Tüketimini Etkileyen Faktörler Üzerine Bir Uygulama: Türkiye Örneği(2010) Temiz, DilekTürkiye sigara tüketiminde başta gelen ülkelerden birisidir. Günümüzde, sigara geleneksel bir tüketim maddesi halini almış durumdadır. Bu çalışmadaki amaç, 1980-2008 dönemi için, Türkiye’de sigara tüketimini etkileyen faktörleri bir ekonometrik model çerçevesinde incelemektir. Oluşturulan sigara tüketim modelinde, GSMH, işsiz nüfus, 15 yaş ve üstü nüfus, şehir nüfusu, kır nüfusu ve sigara fiyatı sigara tüketimini etkileyen önemli değişkenler olarak alınmıştır. Bu değişkenler ile sigara tüketimi arasındaki ilişki En Küçük Kareler (EKK) yöntemiyle tahmin edilmiştir. EKK yöntemi sonucunda Türkiye’de sigara tüketimiyle işsiz nüfus ve sigara fiyatları ile sigara tüketimi arasında ters yönlü ilişkilerin olduğu; kentleşme oranının sigara tüketiminin azalmasında önemli derecede rol oynadığı; 15 yaş ve üstü nüfus ile GSMH’nin ise sigara tüketimini artıran en önemli değişkenler olduğu sonuçlarına ulaşılmıştır. Elde edilen sonuçlara göre, sigara tüketimini azaltmak için, Türkiye’de sigara fiyatlarının enflasyon oranının üzerinde arttırılması önerilebilir. Ayrıca, Türkiye’de sanayileşmenin yaygınlaşmasının şehirleşme oranını ve yüksek eğitimli okumuş insan sayısını arttırması ve geleneksel sigara tüketimi alışkanlığının böylelikle değişmesi de mümkün görünmektedirArticle Citation - WoS: 2Citation - Scopus: 2Symmetric and Asymmetric Relationship Between Maritime Transportation and Foreign Trade Volume(inderscience Enterprises Ltd, 2021) Dinc, Dilek Temiz; Karamelikli, HuseyinIn this study, the short and the long-run relationship between maritime transportation and foreign trade volume and also the linear and nonlinear characteristics of this relationship were investigated. Linear relations between maritime transportation and foreign trade volume were analysed by the autoregressive distributed lag (ARDL) model, and nonlinear relations were analysed by the nonlinear autoregressive distributed lag (NARDL) model by using monthly data between 2004 and 2018 in Turkey. According to the results, it was revealed that only the short-run asymmetry and long-run symmetry model was statistically valid and that results should be taken into consideration.Article The Effect of Technological Development on Renewable Energy(IGI Global, 2025) Avşar, D.; Temiz, D.; Gökmen, A.Renewable energies have an essential role in the reduction of external dependency of countries by meeting their energy needs from domestic resources, sustainable energy use as a result of diversification of resources and minimizing the damage to the environment from energy consumption. The study aims to measure technological developments' impact on Turkey’s renewable energy production. Therefore, this study uses annual time series data on Turkey from 1980-2022 to investigate the causal link between technology and renewable energy production. This study applies Augmented Dickey-Fuller (ADF) (1981), Phillips-Perron (PP) (1988), Kwiatkowski-Phillips-Schmidt-Shin (KPSS) (1992) and Ng-Perron (2001) tests for data analysis. In the long run, it has been found that there is a significant positive relationship between technological development and renewable energy; in addition, it has been found that there is a bidirectional causality relationship between renewable energy production and economic growth in the short term. © 2025 IGI Global. All rights reserved.Book Part The Effect of Net FDI Inflow on Economic Growth in Turkey: An Application With Toda-Yamamoto Approach(2022) Temiz, Dilek; Gökmen, AytaçCapital is one of the first and foremost requisites of economic development for every country in this world. However, not every country is given abundant capital. Foreign direct investment (FDI) occurs as a good cure to solve capital-related issues. In this study, the net FDI inflow and economic growth correlation was researched in Turkey for the period of 2010:1-2018:3 by employing quarterly data as well as applying the Augmented Dickey Fuller Test (ADF); Phillips-Perron (PP); Kwiatkowski, Phillips, Schmidt, Shin (KPSS); Elliott, Rothenberg, and Stock (ERS) Point Optimal; Ng-Perron Unit Root Tests; and Toda-Yamamoto Causality Tests. According to the findings of the study, there is a unidirectional causality running from net FDI to economic growth in Turkey.Article The State of The Turkish Textile and Ready-Wear Industries(2016) Duran, Aslı; Dinç, Dilek TemizTekstil ve hazır giyim sanayii Türk ekonomisinin büyümesini sağlayan başlıca sektörler arasındadır. Hem iç hem uluslararası piyasada Türkiye şuan ki rekabet gücünü bu sektörler sayesinde kazanmıştır denilebilir. Bu çalışma toplam dört bölümden oluşmaktadır. Girişten sonraki ikinci bölümde, Türk tekstil ve hazır giyim sanayiinin rekabet gücünden bahsedilmektedir. Daha sonra, bu sektörlerdeki sorunlar değerlendirilmekte ve bir SWOT analiz yapılmaktadır. Çalışmada, küresel pazara ayak uydurabilmek için Türkiye'nin daha fazla teknoloji içeren tekstil üretimine (teknik tekstil) odaklanması gerektiği sonucuna ulaşılmaktadırArticle Türk Savunma Sanayiinde Offset Uygulamaları(2013) Temiz, Dilek; Yazıcı, Mehmet; Erdoğan, DuyguOffset uygulamalarının dunya ticareti icerisindeki yeri ve onemi giderek artmaktadır. Offset uygulamaları, ozellikle yeni teknolojilere ulaşmada ve yeni yatırımların finansmanında onemli bir arac olarak gundeme gelmektedir. Turkiyede offset uygulamalarından savunma sanayi projelerinde yaygın bir şekilde yararlanılmaktadır. Turk Silahlı Kuvvetlerinin ihtiyac duydu.u silah, arac ve gereclerin sa.lanmasında karşılaşılan yuksek maliyetleri azaltmak ve bu arac-gerecler icin yapılan ithalatın odemeler dengesinde meydana getirdi.i acı.ı en az duzeye indirmek amacıyla Turkiyede offset uygulamalarına son yıllarda a.ırlık verilmeye başlanmıştır. Bu calışmada, offset kavramı, offset turleri ve offsetin amacları hakkında bilgi verilerek, dunya ticareti ve gelişmekte olan bir ulke olarak Turkiye icin offset uygulamalarının onemi uzerinde durulmaktadır. Ayrıca, gecmişten gunumuze Dunyada ve Turkiyede offset uygulamaları ve offset projeleri hakkında da bilgi verilmektedir.Article Düzce İl Merkezinde 1999 Depreminden Sonra Yapılankonutlarda Yaşayan Ailelerin Demografikfaktörlere Göre Memnuniyet Derecelerinin Ölçülmesi(2021) Gökmen, Aytaç; Nakip, Mahir; Dinç, Dilek Temiz; Şengül, Semihİnsanların en temel ihtiyaçlarından biri barınma ihtiyacıdır. Konutlar barınma ihtiyacını karşılayan fiziki mekânlardır. Satın alınan konutlar, uzun süreli tüketim özelliği taşıyan ve bu özelliği sayesinde gelecek nesillere aktarılabilen varlık türleridir. Günümüzde konut talebi nüfus artışına bağlı olarak artmaktadır. Bu artış ise gayrimenkul piyasasındaki rekabeti arttırmaktadır. Artan rekabet ise gayrimenkul sektöründe hedef kitlenin doğru seçimini gerekli kılmaktadır. Dünya'da olduğu gibi Türkiye'de de hedef kitlenin doğru seçimi ve hedef kitlenin talepleri doğrultusunda konut pazarlama stratejilerinin geliştirilmesi oldukça önemlidir. Gayrimenkul sektörünün hedef kitlesi belirlenirken çeşitli unsurlara bakılabilir. Bunlar içinde en önemlilerinden birisi demografik unsurlardır. Demografik unsurlar açısından cinsiyet, yaş, medeni durum, eğitim düzeyi ve belli bir mesleğe sahip olma önem taşımaktadır. Bu araştırmanın amacı, Türkiye’de yaşanan Düzce depreminden sonra, yapılan konutlarda memnuniyet düzeyini ölçmek ve bu memnuniyetin ailelerin demografik özellikleri itibariyle bir farklılık gösterip, göstermediğini anlamaya çalışmaktır. Araştırmanın sonuçlarında, 1999 depreminden sonra inşa edilen konutlarda yaşayan ailelerin oldukça memnun oldukları görülmektedir. Ayrıca, tüketici tercihlerinin yaşlara bağlı olarak farklılık gösterdiği de bulunmuştur. Buna ek olarak, katılımcılar genellikle konut üreticileri tarafından sunulan hizmet kalitesinden memnundurlar. Ancak, katılımcıların eğitim seviyesi arttıkça, memnuniyet düzeyi azalmakta ve bu da başka bir araştırmanın konusu olabilmektedir.Araştırma sonucunda, tüketicilerin demografik özelliklerinin konut tercihlerini etkilediği ifade edilebilir.