Öcal, Nadir

Loading...

Profile URL

Name Variants

Ocal, Nadir

Job Title

Prof. Dr.

Email Address

nocal@cankaya.edu.tr

Main Affiliation

03.03. İktisat

İktisat

03. İktisadi ve İdari Birimler Fakültesi

01. Çankaya Üniversitesi

İktisat

03. İktisadi ve İdari Birimler Fakültesi

01. Çankaya Üniversitesi

Status

Current Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Files

Sustainable Development Goals

This researcher does not have a Scopus ID.

This researcher does not have a WoS ID.

Google Analytics Visitor Traffic

| Journal | Count |

|---|

Current Page: 1 / NaN

Scopus Quartile Distribution

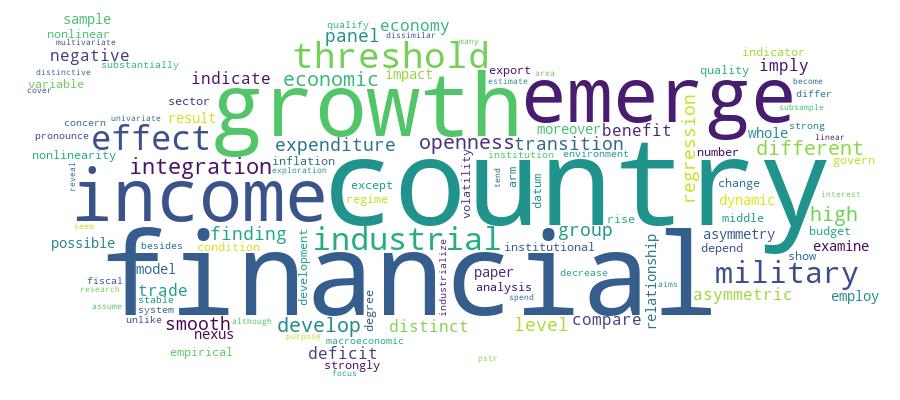

Competency Cloud

3 results

Scholarly Output Search Results

Now showing 1 - 3 of 3

Article Citation - WoS: 9Citation - Scopus: 7Distinct Asymmetric Effects of Military Spending on Economic Growth for Different Income Groups of Countries(Taylor & Francis Ltd, 2023) Ocal, Nadir; Yildirim, Julide; Karadam, Duygu YolcuAlthough possible asymmetries for univariate and multivariate dynamics have been the focus of interest in many areas of economic explorations, it seems that most of the research on military expenditure - economic growth nexus has tended to assume linear relationships. This paper aims to examine possible nonlinearities in military expenditure-economic growth nexus employing data for a sample of 103 countries covering the 1988-2019 period. For this purpose, Panel Smooth Transition Regression, PSTR, models are estimated not only for all countries' sample but also for low income, middle income, and high-income countries' subsamples to reveal possible distinct asymmetric relationships for country groups with different income levels. Empirical results for the whole sample, low income and middle income groups indicate that military expenditure not only governs the regime change, but also low and high levels of military expenditure have distinctive and rising negative effects on economic growth with dissimilar threshold effects. Moreover, empirical findings also indicate that net arms exports govern regime change for high income countries, and as net arms exports rise, the negative impacts of military expenditure on economic growth become deeper.Article Citation - WoS: 4Citation - Scopus: 5Analysis of Distinct Asymmetries in Financialintegration-Growthnexus for Industrial, Emerging and Developing Countries(Wiley, 2022) Ocal, Nadir; Yolcu Karadam, DuyguThis paper examines the threshold conditions in financial integration and growth relationship for a large set of threshold variables and different income group of countries employing Panel Smooth Transition Regression Models. Except developing countries, our findings strongly indicate nonlinear dynamics and imply that the impact of financial integration on growth is asymmetric depending on a number of indicators such as countries' degree of institutional quality, financial sector development, trade openness, budget deficit, inflation volatility and the level of financial integration. Our results show that these threshold effects substantially differ for emerging and industrial countries. As far as whole set of countries is concerned, our findings imply that countries having developed financial systems, qualified institutions and stable macroeconomic environment benefit from financial integration. Moreover, threshold effects are stronger and different for emerging countries compared to the industrial countries. Unlike emerging economies, higher levels of financial integration and trade openness decrease benefits from financial openness for the industrial countries. Besides, high fiscal deficit has more pronounced negative effect on the growth of the industrialized countries compared to emerging economies and other indicators.Article Analysis of distinct asymmetries in financial integration‐growth nexus for industrial, emerging and developing countries(2020) Yolcu Karadam, Duygu; Öcal, NadirThis paper examines the threshold conditions in financial integration and growth relationship for a large set of threshold variables and different income group of countries employing Panel Smooth Transition Regression Models. Except developing countries, our findings strongly indicate nonlinear dynamics and imply that the impact of financial integration on growth is asymmetric depending on a number of indicators such as countries' degree of institutional quality, financial sector development, trade openness, budget deficit, inflation volatility and the level of financial integration. Our results show that these threshold effects substantially differ for emerging and industrial countries. As far as whole set of countries is concerned, our findings imply that countries having developed financial systems, qualified institutions and stable macroeconomic environment benefit from financial integration. Moreover, threshold effects are stronger and different for emerging countries compared to the industrial countries. Unlike emerging economies, higher levels of financial integration and trade openness decrease benefits from financial openness for the industrial countries. Besides, high fiscal deficit has more pronounced negative effect on the growth of the industrialized countries compared to emerging economies and other indicators.