Çorakcı, Ayşegül

Loading...

Profile URL

Name Variants

Corakci, Aysegul

Çorakçı, Ayşegül

Çorakçı, Ayşegül

Job Title

Prof. Dr.

Email Address

aeruygur@cankaya.edu.tr

Main Affiliation

İktisat

Status

Current Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Files

Sustainable Development Goals

7

AFFORDABLE AND CLEAN ENERGY

2

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

2

Research Products

9

INDUSTRY, INNOVATION AND INFRASTRUCTURE

1

Research Products

13

CLIMATE ACTION

2

Research Products

17

PARTNERSHIPS FOR THE GOALS

3

Research Products

This researcher does not have a Scopus ID.

This researcher does not have a WoS ID.

Scholarly Output

10

Articles

10

Views / Downloads

616/133

Supervised MSc Theses

0

Supervised PhD Theses

0

WoS Citation Count

59

Scopus Citation Count

58

WoS h-index

4

Scopus h-index

4

Patents

0

Projects

0

WoS Citations per Publication

5.90

Scopus Citations per Publication

5.80

Open Access Source

4

Supervised Theses

0

Google Analytics Visitor Traffic

| Journal | Count |

|---|

Current Page: 1 / NaN

Scopus Quartile Distribution

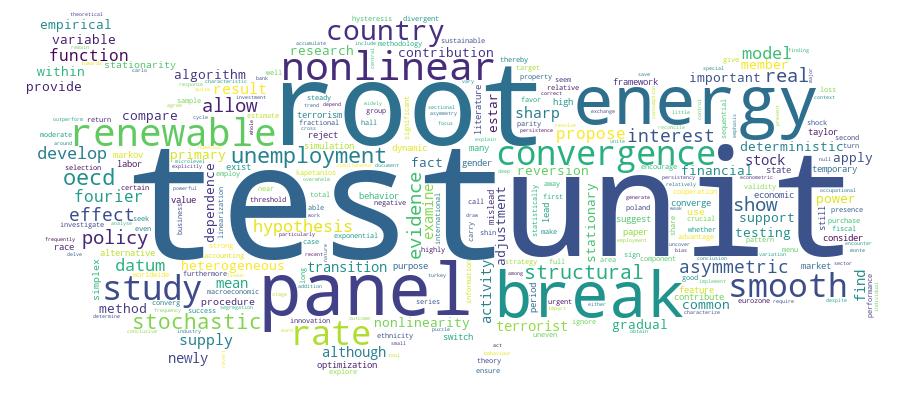

Competency Cloud

Scholarly Output Search Results

Now showing 1 - 10 of 10

Article Citation - WoS: 2Citation - Scopus: 2On the Heterogeneous Effects of Tax Policy on Labor Market Outcomes(Wiley, 2022) Adnan, Wifag; Arin, Kerim Peren; Corakci, Aysegul; Spagnolo, NicolaMany recent studies have documented the heterogeneous effects of government-spending shocks on major macroeconomic variables, particularly on output. We delve deeper into the heterogeneous effects of fiscal policy innovations, but focus on the tax policy innovations and their impact on the labor market, while accounting for gender, race, ethnicity, and the business cycle. Using microlevel data from the United States, we find that: (i) Tax shocks have varying employment effects depending on gender, race, and the stage of the business cycle; (ii) Sector, industry, and occupational segregation in labor markets by gender, race, and ethnicity can explain most of the variation in response to fiscal policy shocks.Article Citation - WoS: 10Citation - Scopus: 11Is There Convergence in Renewable Energy Deployment? Evidence From a New Panel Unit Root Test With Smooth and Sharp Structural Breaks(Pergamon-elsevier Science Ltd, 2023) Omay, Tolga; Corakci, AysegulThis study examines whether the contribution of renewable energy to the total primary energy supply converges in a panel of 24 OECD countries over the period 1960-2020. To this end, a new panel unit root test that allows for both sharp and smooth breaks is proposed to test for the stochastic convergence hypothesis. Although renewable energy convergence is not rejected when the newly proposed test is applied to the full panel of OECD countries, it found only moderate support within the members of the panel using a sequential panel selection methodology. In fact, in two high-income OECD countries, the contribution of renewable energy to the primary energy supply shows no sign of convergence: Poland and Iceland. Therefore, the renewable energy shares seem to be converging to a common steady state in only a group of OECD countries over the long run. This uneven pattern of convergence, in turn, suggests that the OECD countries are still far away from developing a common sustainable renewable energy target, calling for urgent international policy cooperation to encourage the divergent econo-mies to seek out the menu of policies that ensure the worldwide success of renewable energy transformation.Article Citation - WoS: 25Citation - Scopus: 23Real Interest Rates: Nonlinearity and Structural Breaks(Physica-verlag Gmbh & Co, 2017) Corakci, Aysegul; Emirmahmutoglu, Furkan; Omay, TolgaReal interest rate is a crucial variable that determines the consumption, investment and saving behavior of individuals and thereby acts as a key policy tool that the central banks use to control the economy. Although many important theoretical models require the real interest rates to be stationary, the empirical evidence accumulated so far has not been able to provide conclusive evidence on the mean reverting dynamics of this variable. To resolve this puzzle we re-investigate the stochastic nature of the real interest rates by developing unit root tests for nonlinear heterogeneous panels where the alternative hypothesis allows for a smooth transition between deterministic linear trends around which stationary asymmetric adjustment may occur. When the newly developed panel unit root tests are applied to the real interest rates of the 17 OECD countries, we were able to uncover overwhelming empirical support in favor of mean reversion in the short-run and long-run real interest rates. Therefore, these results show that the conclusions drawn from a miss-specified test that ignores the presence of either nonlinearity, structural breaks or cross sectional dependence can give quite misleading results about the stochastic behavior of the real interest rates.Article Is there convergence in renewable energy deployment? Evidence from a new panel unit root test with smooth and sharp structural breaks(2023) Çorakçı, Ayşegül; Omay, TolgaThis study examines whether the contribution of renewable energy to the total primary energy supply converges in a panel of 24 OECD countries over the period 1960–2020. To this end, a new panel unit root test that allows for both sharp and smooth breaks is proposed to test for the stochastic convergence hypothesis. Although renewable energy convergence is not rejected when the newly proposed test is applied to the full panel of OECD countries, it found only moderate support within the members of the panel using a sequential panel selection methodology. In fact, in two high-income OECD countries, the contribution of renewable energy to the primary energy supply shows no sign of convergence: Poland and Iceland. Therefore, the renewable energy shares seem to be converging to a common steady state in only a group of OECD countries over the long run. This uneven pattern of convergence, in turn, suggests that the OECD countries are still far away from developing a common sustainable renewable energy target, calling for urgent international policy cooperation to encourage the divergent economies to seek out the menu of policies that ensure the worldwide success of renewable energy transformation.Article Citation - WoS: 11Citation - Scopus: 9Ppp Hypothesis and Temporary Structural Breaks(Economics Bulletin, 2017) Corakci, Aysegul; Omay, Tolga; Emirmahmutoglu, Furkan; Çorakcı, Ayşegül; Tolga, Omay; Çankaya Meslek Yüksekokulu; İktisatIn this study our aim is to explore a better testing strategy for the PPP hypothesis under a temporary structural break. For this purpose we use the exponential smooth transition (EST) function in the unit root testing framework and compare this methodology with the one that uses a Fourier function. Although the Fourier function is extensively used in the literature to test the validity of the PPP hypothesis under temporary breaks, this investigation shows that it leads to misleading results.Article Is there a Purchasing Power Parity (PPP) Puzzle? New Evidence from a Nonlinear Asymmetric Panel Unit Root Test(2016) Çorakçı, AyşegülThis study re-examines the validity of the purchasing power parity (PPP) hypothesis for 24 OECD countries. The econometric methodology implemented not only allows for asymmetric nonlinear mean reversion within a panel context, but also corrects for the cross-sectional dependence bias frequently encountered in panel data. This feature is important because a test that ignores the presence of asymmetry and cross-sectional dependence when they are in fact present in the data would lead to misleading results. We obtain relatively stronger evidence in favor of the PPP hypothesis when compared to the other alternative panel unit root tests. However, on the whole, this support is still weak even after allowing for asymmetric nonlinear mean reversion in the real exchange rate series. Therefore, to reconcile the data with the theory further methods should be developed.Article Citation - WoS: 3Citation - Scopus: 4High Persistence and Nonlinear Behavior in Financial Variables: a More Powerful Unit Root Testing in the Estar Framework(Mdpi, 2021) Corakci, Aysegul; Hasdemir, Esra; Omay, TolgaIn this study, we consider the hybrid nonlinear features of the Exponential Smooth Transition Autoregressive-Fractional Fourier Function (ESTAR-FFF) form unit root test. As is well known, when developing a unit root test for the ESTAR model, linearization is performed by the Taylor approximation, and thereby the nuisance parameter problem is eliminated. Although this linearization process leads to a certain amount of information loss in the unit root testing equation, it also causes the resulting test to be more accessible and consistent. The method that we propose here contributes to the literature in three important ways. First, it reduces the information loss that arises due to the Taylor expansion. Second, the research to date has tended to misinterpret the Fourier function used with the Kapetanios, Shin and Snell (2003) (KSS) unit root test and considers it to capture multiple smooth transition structural breaks. The simulation studies that we carry out in this study clearly show that the Fourier function only restores the Taylor residuals of the ESTAR type function rather than accounting forthe smooth structural break. Third, the new nonlinear unit root test developed in this paper has very strong power in the highly persistent near unit root environment that the financial data exhibit. The application of the Kapetanios Shin Snell- Fractional Fourier (KSS-FF) test to ex-post real interest rates data of 11 OECD countries for country-specific sample periods shows that the new test catches nonlinear stationarity in many more countries than the KSS test itself.Article Citation - WoS: 7Citation - Scopus: 8Hysteresis and Stochastic Convergence in Eurozone Unemployment Rates: Evidence From Panel Unit Roots With Smooth Breaks and Asymmetric Dynamics(inst Badan Gospodarczych, 2022) Omay, Tolga; Hasanov, Mubariz; Corakci, AysegulResearch background: Studying the dynamic characteristics of unemployment rate is crucial for both economic theory and macroeconomic policies. Despite numerous research, the empirical evidence about stochastic behaviour of the unemployment rate remains disputable. It has been widely agreed that most economic variables, including unemployment rates, are characterized by both structural breaks and nonlinearities. However, a little work is done to examine both features simultaneously. Purpose of the article: In this paper, we analyse the stationarity properties of unemployment rates of Euro area member countries. Also, we aim to test stochastic convergence of unemployment rates among member countries. Our empirical procedures explicitly allow for simultaneous gradual breaks and nonlinearities in the series. Methods: This paper develops a new unit root test procedure for panel data, allowing for both gradual structural breaks and asymmetric adjustment towards equilibrium. We carry out Monte Carlo simulations to examine small sample performance of the proposed test procedure and compare it to the existing test procedures. We apply the newly proposed test to examine the stochastic properties of the unemployment rates of Euro-member countries as well as relative unemployment rates vis-a-vis the Eurozone unemployment rate. Findings & value added: We find that the newly developed test procedure outperforms existing tests in highly nonlinear settings. Also, these tests reject the null hypothesis of unit root in more cases when compared to the existing tests. We find stationarity in the series only after allowing for structural breaks in the data generating process. Allowing for nonlinear and asymmetric adjustment in addition to gradual breaks provides evidence of stationarity in more cases. Furthermore, our results suggest that relative unemployment rate series are stationary, providing evidence in favour of stochastic convergence in unemployment rates. Overall, our results imply a limited room for coordinated economic policy to fight unemployment in the Eurozone.Article Citation - WoS: 1Citation - Scopus: 1A Unit Root Test With Markov Switching Deterministic Components: A Special Emphasis on Nonlinear Optimization Algorithms(Springer, 2024) Corakci, Aysegul; Omay, TolgaIn this study, we investigate the performance of different optimization algorithms in estimating the Markov switching (MS) deterministic components of the traditional ADF test. For this purpose, we consider Broyden, Fletcher, Goldfarb, and Shanno (BFGS), Berndt, Hall, Hall, Hausman (BHHH), Simplex, Genetic, and Expectation-Maximization (EM) algorithms. The simulation studies show that the Simplex method has significant advantages over the other commonly used hill-climbing methods and EM. It gives unbiased estimates of the MS deterministic components of the ADF unit root test and delivers good size and power properties. When Hamilton's (Econometrica 57:357-384, 1989) MS model is re-evaluated in conjunction with the alternative algorithms, we furthermore show that Simplex converges to the global optima in stationary MS models with remarkably high precision and even when convergence criterion is raised, or initial values are altered. These advantages of the Simplex routine in MS models allow us to contribute to the current literature. First, we produce the exact critical values of the generalized ADF unit root test with MS breaks in trends. Second, we derive the asymptotic distribution of this test and provide its invariance feature.Article Terrorism and the Stock Market: A Case Study for Turkey Using STR Models(2014) Çorakçı, Ayşegül; Omay, TolgaSeveral attempts have been made in the literature to analyze the detrimental effects of terrorist activities on the stock market. However, in neither of these studies the effects of terrorist activities on stock returns are investigated through employing nonlinear models in spite of the fact that most financial data is shown to exhibit nonlinear behaviour. This study, therefore, aims to contribute to this growing area of research by exploring the potential nonlinear effects of terrorist activities on stock returns by employing smooth transition regression (STR) models. Our results show that terrorism has a statistically significant negative effect on the stock index when the intensity of terrorist activities passes a certain threshold level. This negative effect continues for terrorist activities below this threshold level, but becomes statistically insignificant. This study by conducting the analysis within a nonlinear framework offers important insights into the investors who want to make portfolio diversification strategies against terrorism risk.